Why Budgeting Is Important?

2021 is almost over, but the pandemic is still ongoing and isn’t showing any signs of slowing down or stopping any time soon. A lot of people got laid off, businesses shut down, coupled with political unrest and bouts of natural disasters caused by our changing climate have caused economies to falter even more.

Author:Paolo ReynaOct 07, 202147.5K Shares1.1M Views

2021 is almost over, but the pandemic is still ongoing and isn’t showing any signs of slowing down or stopping any time soon. A lot of people got laid off, businesses shut down, coupled with political unrest and bouts of natural disasters caused by our changing climate have caused economies to falter even more. Having and sticking to a budget has never been more important, now more than ever. But first, what is a budget?

What Is A Budget?

“A budget is telling your money where to go instead of wondering where it went,” New York Times best-selling author and radio broadcaster Dave Ramsey once stated. Budgeting is a fundamental financial tool. It's the same as having your doctor take your height, weight, blood pressure, body temperature, and pulse.

Why Budgeting Is Important?

Budgeting is essential for financial stability since it ensures that you can pay for everyday expenses such as rent, tuition, student loans, credit card bills, and entertainment. It's a proactive approach to financial organization. Budgeting guarantees that you don't spend more than you earn, allowing you to plan for both short- and long-term needs. It's a simple, effective technique for people with a variety of income and spending to keep their finances in line. You just want to be able to track your revenue after deducting all expenses to guarantee you don't get into debt.

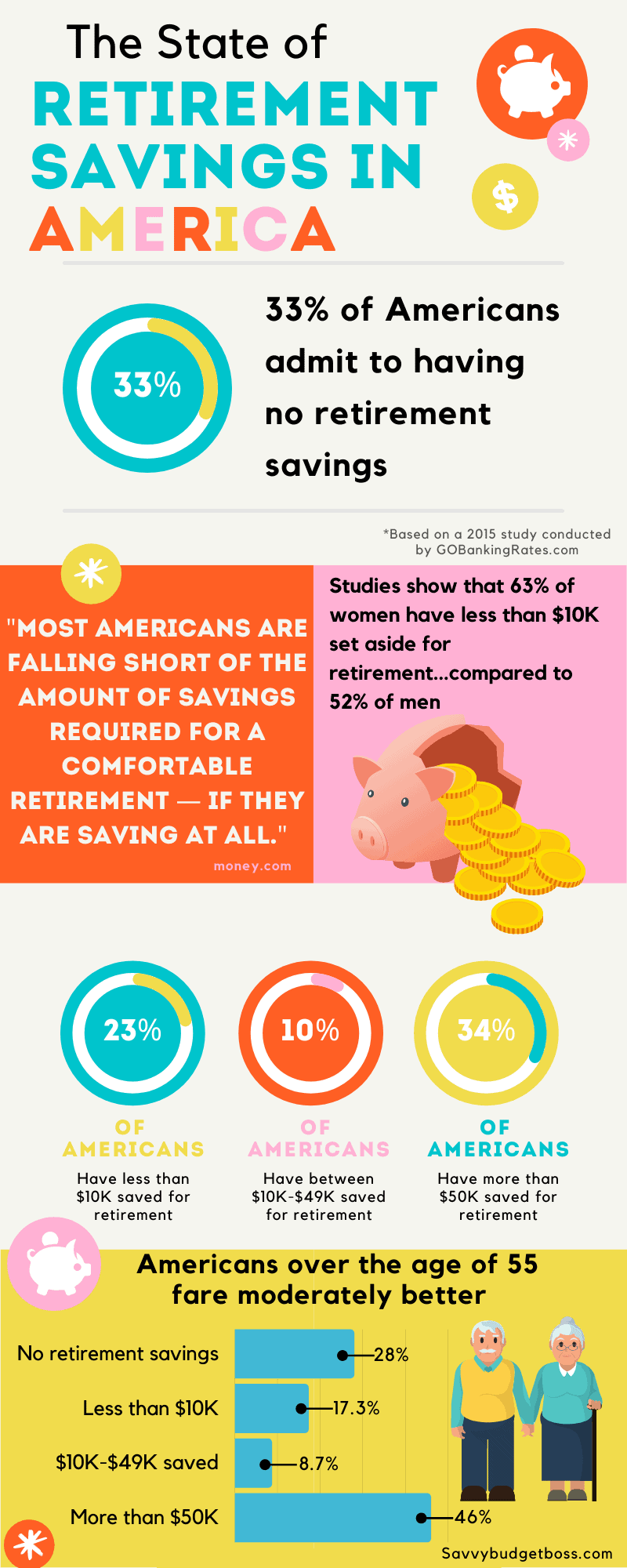

The Significance Of Retirement Planning

According to studies, a staggering proportion of Americans (33%) have little to no money set up for retirement. This indicates that the majority of Americans are unaware of the significance of a budget.

Who Needs To Do Budgeting?

Everyone needs to have a budget. Whether you have a fixed monthly wage or work independently and have a fluctuating salary throughout the year, learning to budget can be quite beneficial to your overall financial status. Budgeting is the proper instrument for the job if your ultimate objective is financial freedom.

Online Tools For Budgeting

The greatest budgeting tools for keeping track of your expenditure; free and paid applications and websites to assist you in managing your cash flow and saving more money.

If you've had trouble budgeting your money in the past, you might just need some assistance. Thankfully, there is a lot of aid available nowadays with the plethora of budgeting apps that make money management simple. Some even go above and beyond basic budgeting by assisting you in reducing your bills, saving money, or even providing investing advice.

When it comes to how much this will cost you, budgeting apps will not be an issue because many of them are available for free. Others only charge a little annual or monthly fee. Except for Trim, which is an AI assistant, all of these apps are available on your mobile device. Whatever path you take, you will undoubtedly have a greater understanding of your finances and begin to accumulate the savings that will eventually lead to financial freedom.

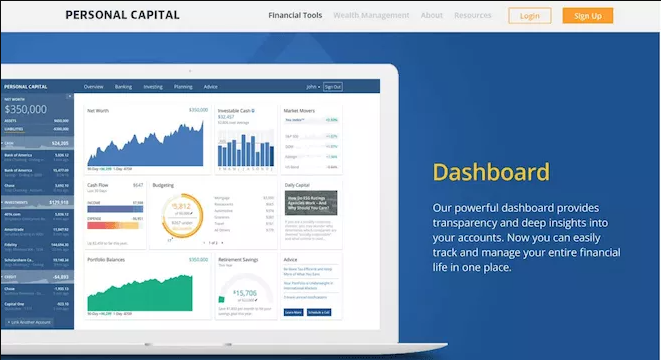

Personal Capital

Personal Capital has swiftly established itself as one of the leading budgeting and financial aggregation apps on the market. Personal Capital provides free budgeting software as well as tools to help you manage your money. More than two million people use the basic app, which is absolutely free. Not only does it help you budget and get a birds-eye perspective of your money, but it also has useful investment tools like the Fee Analyzer, which shows you how much you're spending in fees in your retirement plan.

It also provides customized asset allocations and retirement planning services. That's a lot of functionality for free software!

If you have a minimum of $100,000 to invest and want total investment management, Personal Capital also offers its Wealth Management plan, which is a premium service with an annual cost of 0.89 percent. With Wealth Management, you'll have access to a financial advisor on a regular basis.

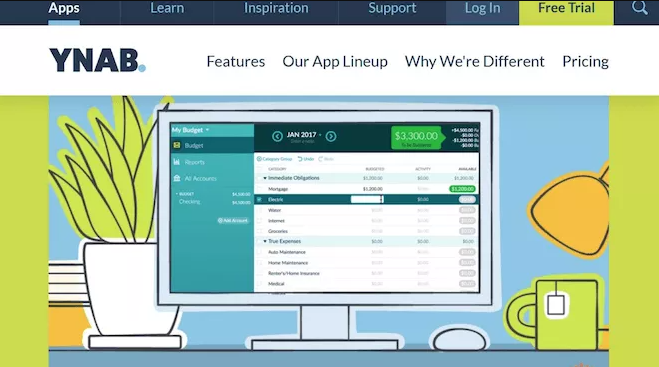

You Need A Budget (YNAB)

We all know what the most difficult part of budgeting is: being behind on your expenses and having to pay last month's bills with this month's money.

YNAB is a budgeting program that operates similarly to other budgeting apps. However, it also employs a tactic to counteract this all-too-common pattern: living off the previous month's revenue in the current month. The strategy is revolutionary for someone who is having financial difficulties.

If this describes you, YNAB could be a fantastic budgeting program for you.

The Automated Emergency Fund On YNAB

YNAB does more than just manage your income and expenses; it also helps you build that emergency fund automatically. You gradually come to the point where you've built a cushion into your budget so that you always have a month's worth of living expenditures on hand. Setting line item budget restrictions is how this is done mechanically. If you come in under budget, the difference will be put into your one-month emergency fund. That cushion should eventually increase to cover more than 30 days of expenses. This is known as the Age of Money feature, and it states that the older your money is, the better your financial situation is.

You will be able to import transactions from your bank account, which will eliminate the need for manual entry and reconciliation. However, you will have to manually designate spending categories for each transaction. You can also set goals for future costs to help you remain on top of your budget.

CountAbout

A basic, user-friendly budgeting program like CountAbout is definitely worth checking out.

First of all, it is not free: the Basic plan costs $9.99 a year and includes all basic budgeting app functions except automatic downloading of banking, credit card, and other financial transactions. The Premium subscription is $39.99 per year and includes access to all CountAbout features. You can also add small company invoicing capabilities for an extra $60 per year.

Budgeting tools that are simple to use

What’s so good about CountAbout is that it is a straightforward, user-friendly budgeting program. It instantly synchronizes with your financial data from thousands of financial institutions.

You can even sync your 401(k) plan with it. All of this is updated automatically, removing the need for time-consuming human entry. The app also allows you to customize the settings. This includes the ability to customize each field, function, and report within the app.

For those on the road to early retirement, CountAbout's FIRE widget lets you track your progress. Your monthly costs and passive income potential will be organized in a tidy chart, and you can track any budget and asset categories you'd like. However, it does not allow you to create recurring transactions. But it does allow you to schedule payments and even keep tabs on incoming and outgoing funds. A budget for future months can be created in the app, so you can plan your finances ahead of time.

Money Patrol

Data is used by Money Patrol to assist you in managing your finances. You'll be able to see a summary of your spending habits as well as keep track of your forthcoming payments and recurring expenditures. You can quickly add all of your accounts with support for over 15,000 financial institutions. Money Patrol begins monitoring all activity once it is linked. You'll receive alerts if there's ever an issue that you should be concerned about.

Checking and savings accounts aren't the only ones supported. Student loans, business accounts, investments, mortgages, and even some types of gift cards can all be tracked. However, keeping track of your expenditures is only one-half of the puzzle. Money Patrol allows you to make a budget and organize your finances using the knowledge you've learned.

Digit

Budgeting tool Digit automatically analyzes your spending and helps you save money. Digit can help you budget for holidays or significant purchases, pay off debt, or save for a rainy day, no matter what you're saving for. Digit employs a clever algorithm to help you save money quickly and easily. Unlike some other budgeting programs that require you to manually input expenses, track spending, and save money, Digit can work in the background without you having to think about it.

There are no account minimums, automated savings, a 0.10% savings bonus, unrestricted withdrawals, and no account minimums. Goals can be created for anything you want and progress can be tracked.

The first step in using Digit is to connect your bank account. It then analyses your expenditure and transfers the appropriate amount from your bank account to Digit when you can afford it. They pile up over time, making saving easier.

Digit does have a monthly subscription price of $5, however, the savings this technology gives are likely to outweigh the cost of the subscription.

Empower

Making a budget is merely the first step in managing your finances. In addition, Empower is with you every step of the way - from helping you build a budget to keeping tabs on your spending and tracking your progress.

In the end, you'll have an app that puts you in charge of your money. When it comes to managing your finances, Empower may be the app for you.

Budgeting And Spending Help

Most of us who have ever tried to stay on a budget are well aware of the difficulty of doing so. Rather than cooking at home, you give in to the need for a morning coffee or order takeout instead. With Empower, you'll never be out of the hunt for a new record. You'll be able to tell right away if you need to slow it down a bit.

However, Empower does more than that. With Empower AutoSave, you'll also get automatic assistance with saving money for the future.

Your funds are tracked by Empower, which determines when you can afford to save a little extra. Give it your savings goal, whether you're saving for a beach vacation or a retirement. It then finds ways to sneak some money into savings without you even seeing it, which is called "Empower". Around the clock, they monitor your income and expenses to determine if you have excess cash. Financial technology startup Empower is not affiliated with any bank. Services offered by nbkc bank, a member of FDIC.

A cash advance from Empower Cash Advance may be an option for those who don't have enough money on hand but still need a little extra cash to cover an emergency. No credit checks, late fees, or risk to your credit. In addition, you can get paid up to two days faster and earn up to 10% cashback on your purchases with the Empower Card.

PocketSmith

Your financial future is influenced by how you spend your money today. On a daily level, though, it can be difficult to recognize this.

PocketSmith comes in handy here because it has built-in financial predictions. It was fun to try out a few different techniques and see how the graph altered. You can even try out different scenarios, such as skipping your morning coffee and investing or saving the money to see how it would pay off six months, a year, or ten years down the road.

PocketSmith offers three options, and it’s great to know that the Basic package is free. However, if you want to invest a little more, they have a Premium plan that costs $9.95 per month (or $7.50 per year) and includes automatic bank feeds and transaction importing. For $19.95 per month (or less if paid annually), their Super plan offers premium features.

Budgeting Calendar

The calendar is one of the features that distinguishes PocketSmith from other budgeting programs. You can see all of your monthly spendings at a glance. Simply click and drag an expense to its target date if you want to change it to a different day, week, or month.

PocketSmith calculates everything and generates projections, which is one of the best features of the calendar. You'll be able to monitor your anticipated daily balance for each day and make adjustments as needed. Also, the calendar view allows for early detection of tiny problems before they become major ones.

Link your Finances

You can quickly link your bank account to track your financial actions, just like many other financial apps. However, you can label different types of transactions in PocketSmith to make it easier to discover them later. You can also track assets located outside of the United States, as well as perform automatic currency conversions.

It's also not a problem to have multiple sources of income. PocketSmith allows you to keep track of your day job, side business, and other activities individually. This tool is especially useful for Airbnb tenants, as it includes tracking Airbnb income and expenses.

Charlie

In addition to the expenditure tracker, Charlie is a free budgeting program that may help you control your spending in every expense area. My friends appear to be talking about this app.

As a personal finance management tool, Charlie goes beyond simple budgeting and examines your overall financial status.

Every time you use the app, you'll be interacting with "Charlie". The software syncs your bank and credit card accounts, evaluates them, and then tells you where you're overspending and where you may cut back on spending. A low account balance or a payment due date will be alerted to you.

Spend Tracker

However, you may utilize the app to help you better manage your finances. It has a spending tracker that estimates your monthly spending habits, allowing you to focus on a certain sort of spending and even allowing you to establish spending limitations in certain categories.

Mint

Mint is not only free to use, but it also gives you your free credit score.

Mint also offers a credit report summary, as well as credit score education and credit monitoring. To use the service, you don't even need to keep a credit card on file.

Mint is a budgeting app that, for the price, has a surprising variety of tools and functions.

Analyzes Your Spending

Mint's "trends" function is very intriguing. The software will analyze your spending by month, quarter, or a year once you've used it for a few months.

You may also break down your expenditure into categories and individual merchants. This can help you have a better understanding of where your money is going and allow you to make spending cuts when necessary.

Investment Tracking

Investopedia is another feature of the app. You can connect the app directly with your investment accounts, and the app will offer performance, allocation, and changes in value over time as a result. In fact, the software will give investing suggestions as well.

Trim

Even though other budgeting applications have this feature, Trim is best recognized for its ability to negotiate with vendors. Trim is an excellent alternative if you need help with it.

Cable and Internet services, for example, are often accompanied by a variety of obtuse fees. Trim helps you save money on your bills and even helps you locate a better auto insurance policy through their service.

Personal Finance Assistant

"Your personal finance assistant" is how Trim describes itself, and it's a pretty accurate description of this fantastic service. Additionally, it can be used to cancel unwanted subscriptions or services that you may be paying for on a monthly basis, but rarely or never using.

Reduce your debt with Trim. In addition to expert advice and techniques to cut interest rates, you'll receive a debt repayment plan. To obtain better control of your finances, paying off your debt is one of the finest strategies to improve your budget.

Automates Your Savings

Furthermore, the app's Simple Savings function enables automated savings. All you have to do is set up automatic weekly transfers to a savings account, and money will start to accrue on a regular basis.

Trim not only assists you in gaining better control of your budget, but it also directs the savings into an account. You will then receive a 1.5 percent annual bonus on your saved amount.

Advantages Of Budgeting

- organizes cross-departmental activities

- Budgets are used to put strategic plans into effect.

- Budgets are an effective way to keep track of organizational activities.

- Budgets increase staff communication.

- Budgets improve resource allocation by clarifying and justifying all requests.

- Budgets serve as a tool for remedial action by allowing for reallocations.

Disadvantages Of Budgeting

- When budgets are imposed mechanically and rigorously, the main issue arises.

- Employees can be demotivated by budgets due to a lack of engagement. Employees will not comprehend the purpose of budgeted spending and will not be committed to them if budgets are imposed arbitrarily from the top.

- Budgets can provide the impression of unfairness.

- Budgets can lead to resource and political competitiveness.

- A tight budget structure inhibits lower-level initiative and innovation, making it impossible to fund fresh ideas.

I hope that you will be inspired to stay on top of your expenses and be more money-savvy by budgeting. Especially with the holidays soon to roll in, I hope these tools and resources can help you and your family survive this pandemic financially.

Paolo Reyna

Author

Paolo Reyna is a writer and storyteller with a wide range of interests. He graduated from New York University with a Bachelor of Arts in Journalism and Media Studies.

Paolo enjoys writing about celebrity culture, gaming, visual arts, and events. He has a keen eye for trends in popular culture and an enthusiasm for exploring new ideas. Paolo's writing aims to inform and entertain while providing fresh perspectives on the topics that interest him most.

In his free time, he loves to travel, watch films, read books, and socialize with friends.

Latest Articles

Popular Articles